japan corporate tax rate 2022

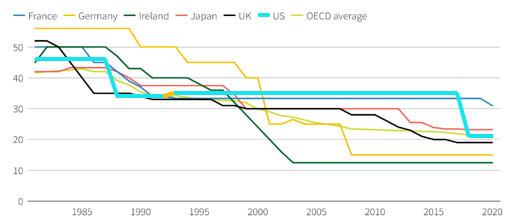

In 2021 20 countries changed their statutory corporate income tax rates. And b approximately 35 with a certain favourable rate for up to the first eight.

Corporate Tax Reform In The Wake Of The Pandemic Itep

EY JapanThe fiscal year 2022 tax reform outline was released on 10 December 2021.

. Local management is not required. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. 6 rows Unit.

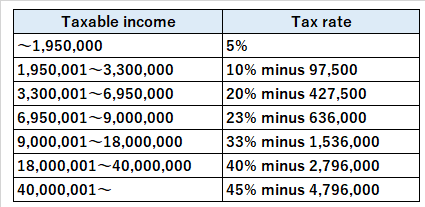

Domestic Companies a 25 if turnovergross receipts do not exceed INR 4 billion for FY 2019-2020 surcharge ranging from 7 to 12 of tax applicable depending upon the total income. Heres how they apply by filing status. 7 rows Japan Income Tax Tables in 2022.

The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. 10 12 22 24 32 35 and 37. The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is.

Corporate and international tax proposals in tax reform package 19 December 2018 The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax measures. B Lower tax rate of 2215 is also applicable to corporate entities subject to certain conditions surcharge 10 of tax applicable. Additionally a local enterprise tax is also levied by the prefecture on corporations.

An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. Argentinas from 30 to 35 and Gilbratars from 10 to 125. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits.

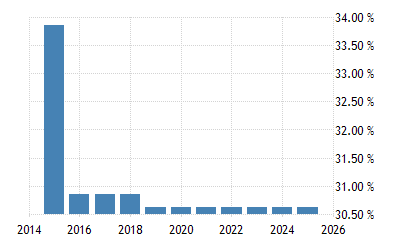

Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Japan VAT Rate 500. Bangladesh raised its rate from 25 to 325. Dec 2014 Japan Corporate tax rate.

Please note that provisions may be revised deleted or. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Exact tax amount may vary for different items.

United Arab Emirates 1605 GDP YoY Forecast. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. 167 rows Corporate Tax Rates in 2021.

The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies with paid-in capital greater than JPY100000000 including Japanese branch-offices of foreign companies with paid-in capital greater than JPY100000000 and subsidiaries of companies. In the long-term the Japan Sales Tax Rate - Consumption Tax is projected to trend around 1000 percent. There are seven tax rates in 2022.

VAT and Sales Tax Rates in Japan for 2022. C 30 surcharge ranging from 7 to 12 of tax applicable. In this alert we provide an overview of the major reforms and revised provisions contained in the outline.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy on corporate inhabitant tax for each taxable year are shown below. Bangladesh Argentina and Gibraltar. A standard corporate income tax rate is 232 applies to the companies that operate in Japan with a share capital over JPY 100 million.

About 5 tax on a 100 purchase. It depends on companys scale location amount of taxable income rates of tax and the other. 2022 Tax Bracket and Tax Rates.

Income Tax Rates and Thresholds Annual Tax Rate. Sales Tax Rate in Japan is expected to reach 1000 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. United States Corporate Tax Rate was 21 in 2022.

In 2000 the average corporate tax rate was 326 percent and has decreased consistently to its current level of 213 percent. Japan Sales Tax Rate - Consumption Tax - values historical data and charts - was last updated on March of 2022. Three countries increased their corporate tax rates.

2022 Corporate Tax Rates in Europe Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. Local inhabitants tax is levied by both prefectures and municipalities that is payable by the companies. Income tax rates.

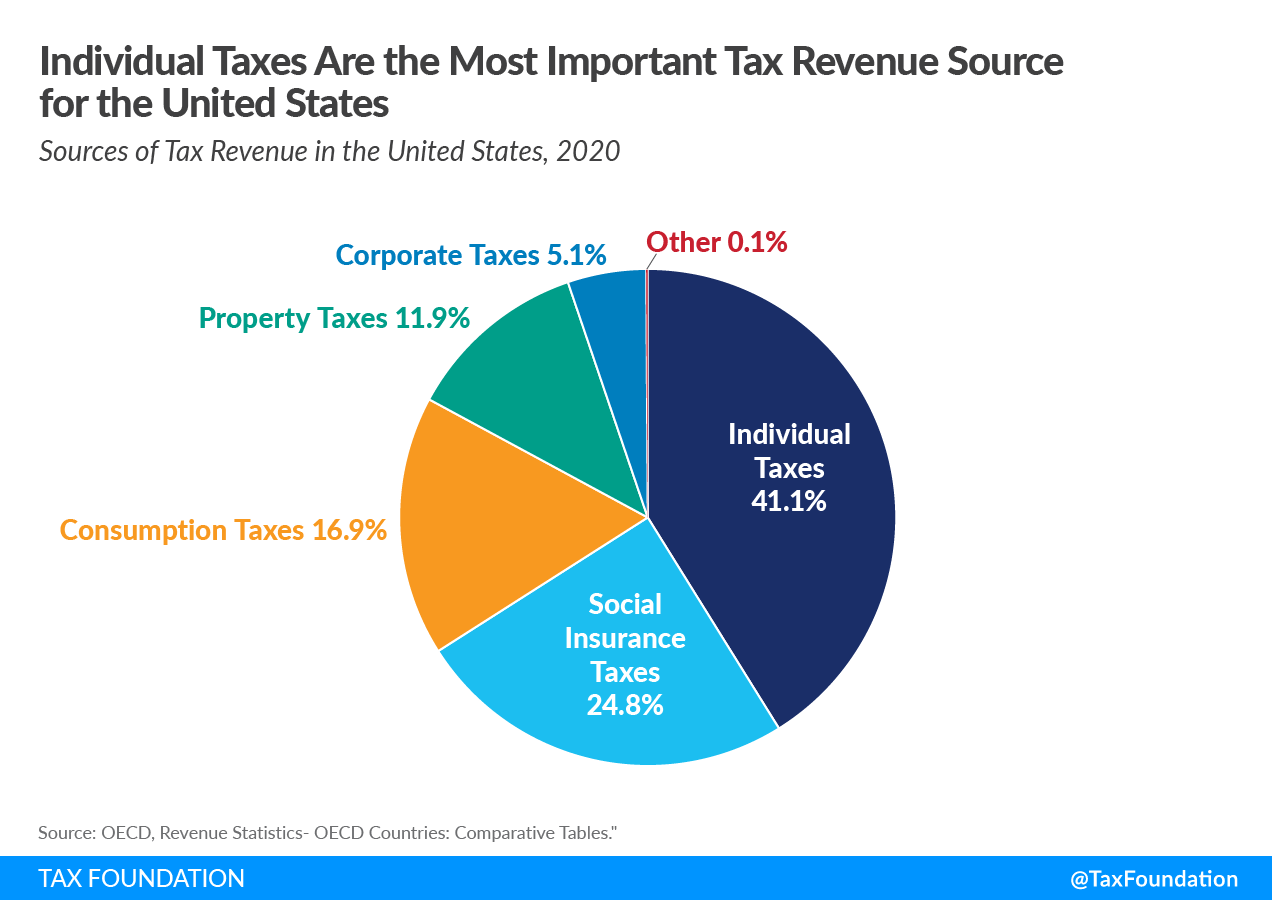

Sources Of Us Tax Revenue By Tax Type Tax Foundation

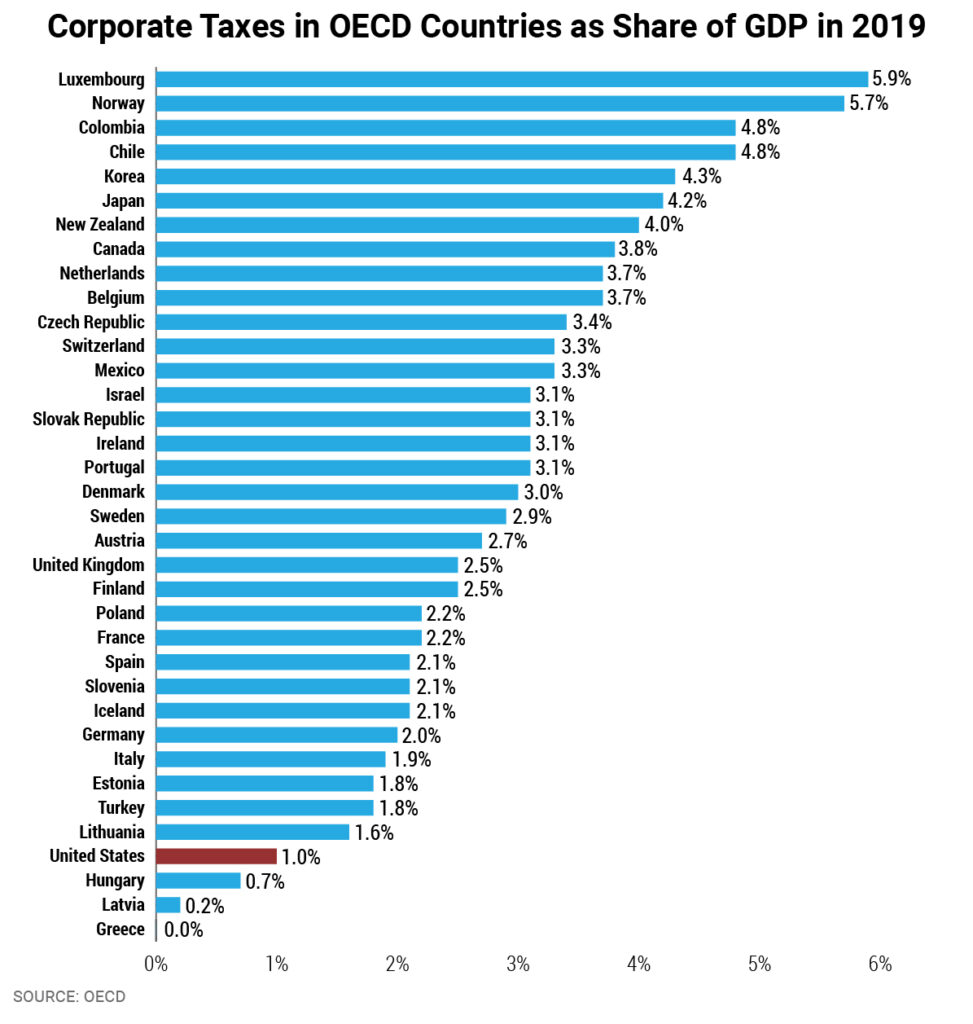

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

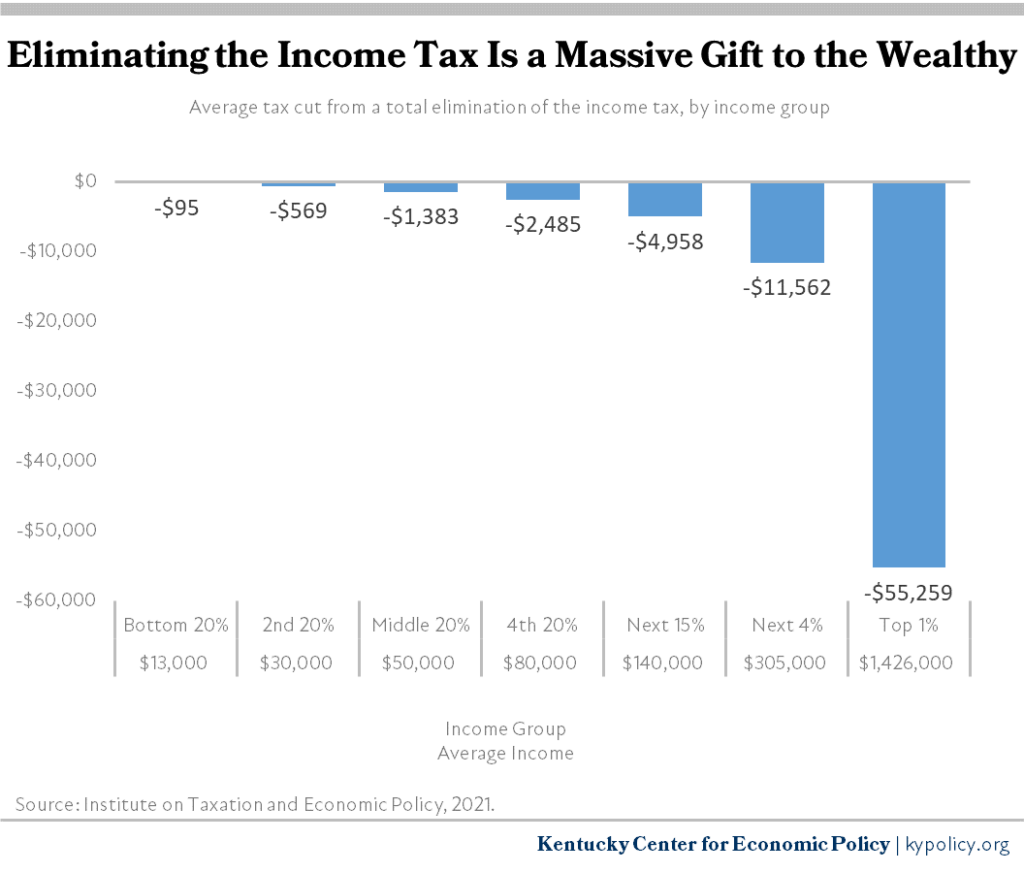

House Tax Bill Would Devastate Kentucky S Budget For A Giveaway To The Wealthy Kentucky Center For Economic Policy

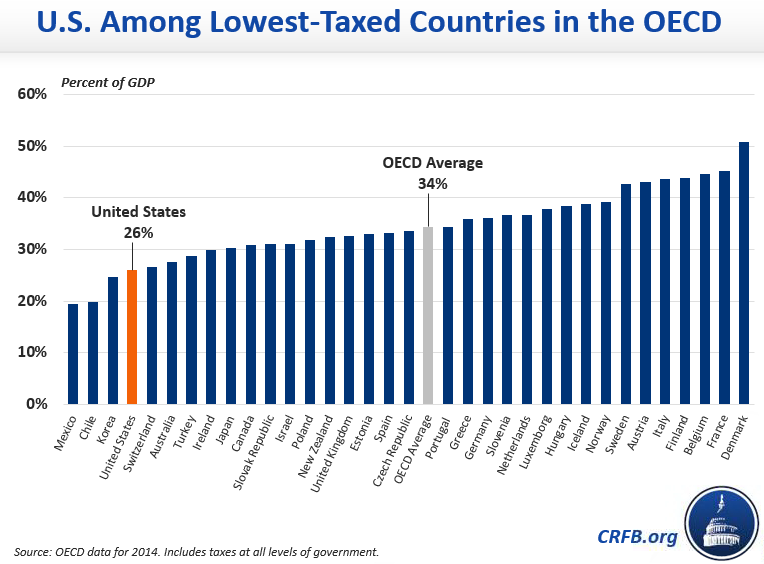

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Global Minimum Corporate Tax Rate Wikipedia

Corporation Tax Europe 2021 Statista

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

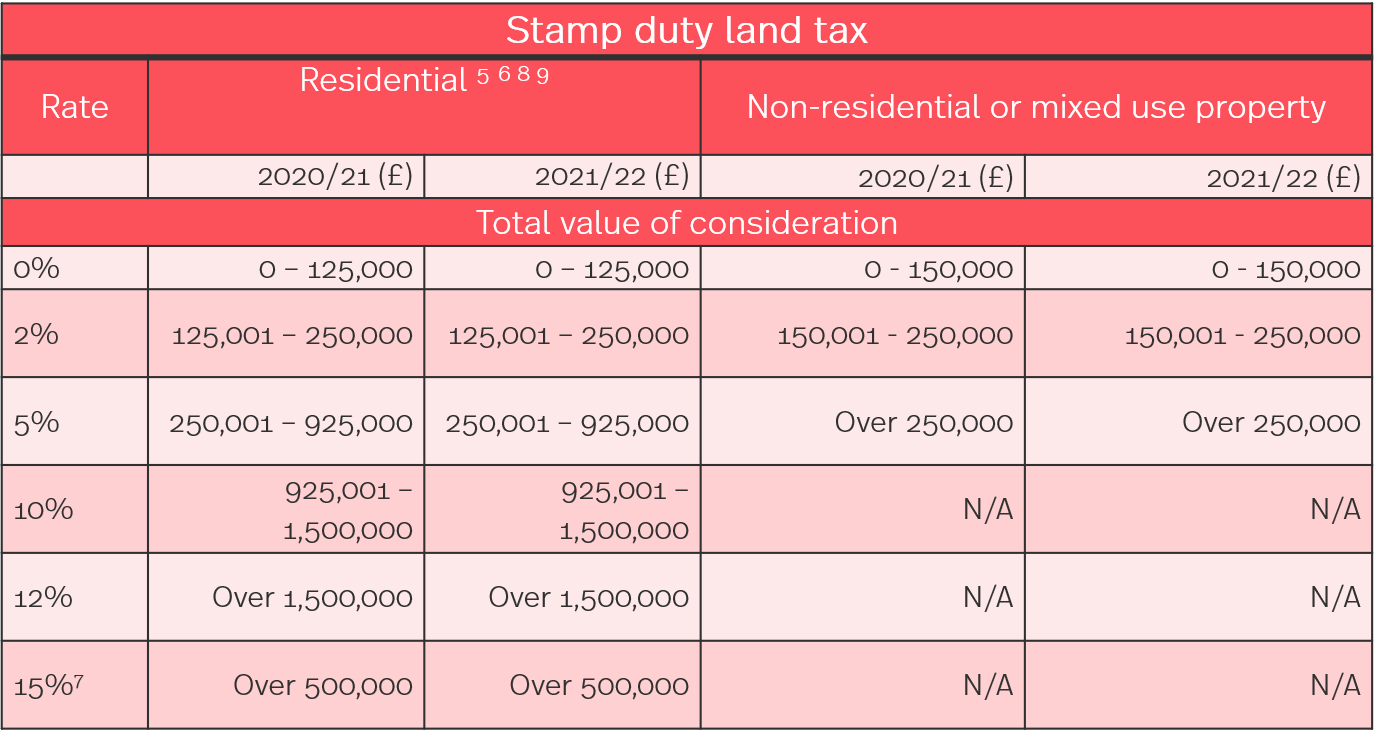

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Doing Business In The United States Federal Tax Issues Pwc

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Corporate Income Tax Cit Rates

United Arab Emirates Corporate Tax Rate 2021 Data 2022 Forecast